This week’s simultaneous launch of the UK’s Industrial Strategy and Technology Adoption Review represents the most significant government intervention in UK industry for over a decade.

While the fanfare focused on billion-pound investment pledges and job creation promises, the impact varies significantly across sectors. Some industries emerge as clear winners with substantial new support, others receive targeted assistance for longstanding challenges, and several areas show promising foundations for future development.

Energy-intensive manufacturing is the big winner

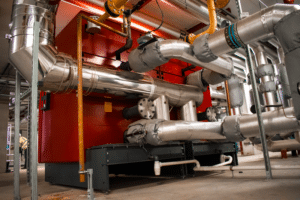

The standout beneficiaries are electricity-intensive manufacturers, particularly in automotive, aerospace, and chemicals. The British Industrial Competitiveness Scheme promises to slash electricity costs by up to 25% from 2027 for over 7,000 businesses. This isn’t just about lower bills – it’s about survival. British manufacturers have been battling some of the world’s highest electricity prices while watching competitors in Germany and France operate with significantly cheaper energy.

The expanded British Industry Supercharger takes this further, increasing electricity network charge discounts from 60% to 90% for the most energy-intensive firms. For steel, ceramics, and glass manufacturers, this could mean the difference between maintaining UK operations or relocating overseas.

Clean energy industries also secured substantial backing, with Great British Energy receiving £700 million for supply chains and specific Scottish projects. The Acorn Carbon Capture and Storage initiative, which received £200 million in previous government announcements, was reaffirmed as a key priority in the Industrial Strategy with continued development funding commitment. Aberdeen’s positioning as a global energy transition hub looks increasingly credible.

Technology Adoption Review: Progress, but with caveats

The Technology Adoption Review reveals both opportunity and ongoing obstacles. The government’s recognition that AI could boost UK productivity by 1.5% annually (worth £47 billion) is significant. The proposed AI adoption hubs and £187 million TechFirst programme signal serious intent.

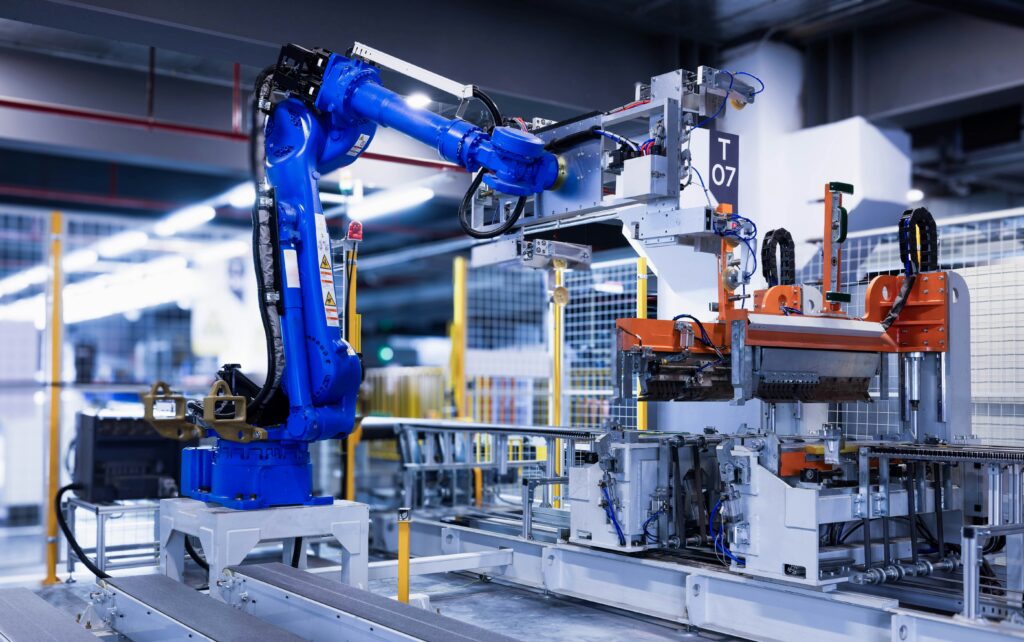

However, the Review exposes concerning adoption gaps. Only 7% of UK manufacturers are considered very knowledgeable about AI applications, and 74% of manufacturing SMEs operate without robots. This isn’t just a technology problem – it’s a competitiveness crisis.

The expansion of Made Smarter builds on proven approaches, with success dependent on sustained implementation. Learning from previous initiatives, the government has committed to longer-term funding cycles and more coordinated delivery mechanisms.

Structural challenges remain

While the Industrial Strategy addresses energy costs – a genuine breakthrough – other fundamental barriers persist. The Technology Adoption Review identifies skills shortages, cyber security concerns, and integration challenges with legacy systems as major obstacles. These aren’t solved by funding announcements alone.

A standout announcement for robotics is the £40 million allocated to create a new network of robotics adoption hubs across the UK. Learning from the successful model of the National Robotarium, these hubs will provide advisory services and connect businesses with suppliers, de-risking technology adoption while showcasing real-world applications. This represents a significant scaling of proven approaches that have already demonstrated their effectiveness in bridging the gap between cutting-edge research and practical industrial implementation.

Scotland’s strategic position

Scotland emerges as a particular beneficiary, leveraging existing strengths in advanced manufacturing, clean energy, and digital technologies. The Edinburgh-Glasgow corridor’s designation for enhanced support recognises its innovation ecosystem, while Aberdeen’s energy transition receives substantial backing.

The Industrial Strategy Zones, including the Forth Green Freeport and Glasgow City Region, will benefit from streamlined planning processes and enhanced investment promotion support. Combined with quantum technology investments and the National Robotarium’s expanding influence, Scotland’s positioning looks strong.

Making it happen

The comprehensive strategy addresses most major industry concerns, though some elements require careful execution. The government’s intention to link carbon pricing systems with the EU represents a sensible approach that should keep revenues supporting UK businesses.

The implementation timeline reflects the scale of change required. While many benefits materialise from 2026-2027, this allows businesses time to prepare and plan investments. The Connections Accelerator Service launching at the end of 2025 provides a clear pathway for companies to engage with streamlined grid access.

The verdict

This Industrial Strategy represents a genuine shift from short-term interventions toward strategic industrial policy. The electricity cost reductions alone justify celebration for manufacturing businesses that have endured years of punitive energy prices.

However, success requires flawless execution and sustained political commitment across electoral cycles. The Technology Adoption Review provides an honest assessment of current weaknesses, but translating insights into widespread adoption remains the ultimate test.

For businesses in our core sectors – energy, technology, and manufacturing – the direction is encouraging. The question isn’t whether government finally understands the challenges, but whether it can deliver solutions at the speed and scale required to maintain UK competitiveness in an increasingly aggressive global market.

The foundations are promising. Now comes the hard part – making it work.

Hot Tin Roof specialises in strategic communications for energy, technology, and manufacturing sectors. Our award-winning team has supported organisations from innovative startups to global industry leaders, including the National Robotarium, SSE Energy Solutions, and pioneering technology companies across Scotland and the UK.