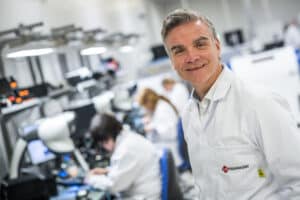

miiCard, the revolutionary digital passport, announced today that it has closed its first funding round and completed a management buyout with James Varga appointed CEO. Raising a total of £550K seed funding from VC, angel and the public sector sources, the round was significantly oversubscribed and completed within six weeks.

miiCard, which is set to launch in beta before the 2011 Christmas retail season, aims to fight internet fraud and protect the consumer by finally solving the issue of trust online. From buying a sofa or selling a bike, to finding a flatmate or applying for a new credit card through the Internet, miiCard allows the individual to prove ‘I am who I say I am’ and create trust when transacting online.

Investment has been secured from angel syndicate Par Equity, venture capital group IQ Capital and the Scottish Investment Bank’s Scottish Seed Fund. miiCard has already generated a huge amount of interest from both financial and commercial sectors and over the coming weeks it expects to make a number of high profile appointments of expert advisors and board members.

The idea behind miiCard is to create trust online in the way that a passport or driving licence does offline, as CEO James Varga explains: “From buying and selling online to using social networks, we often need to be able to prove our identity online and in real-time. miiCard will do that by offering an alternative to the traditional offline checks of driver’s licence, passport or utility bill. There is nothing else on the market today that does this, giving miiCard a massive opportunity.

“That is why this funding round has been so well supported by investors. This is a hugely exciting time for the team at miiCard and we are extremely proud that so much confidence has been shown in us. We know that we have an incredible product with countless applications. We are all looking forward to the coming months.”

Changing the way we transact online forever by providing a system where proof of identity can be validated entirely online and in real-time, miiCard will make online transactions easier, faster and safer.

Owned and managed by the individual, miiCard allows the consumer to track, monitor and so take control of their online identity for the first time. miiCard costs the consumer just £1 a month and is charged to the vendor on a transactional basis.

For more information contact: Sarah Lee.

About miiCard

miiCard is a revolutionary “digital passport”, powered by Yodlee, that enables users to prove their identity online for the first time to the same level of authority as a driving licence or passport would do offline. By creating trust in an environment characterised by anonymity and transient identities, miiCard will open up opportunities for business online and put internet users back in control of their personal information.

The inability easily to authenticate a user’s identity online has long posed a significant barrier to trade. Between 70% and 90% of all online financial transactions are terminated when the customer is required to provide physical proof of identity so it is imperative that businesses find a solution.

miiCard is designed to support ecommerce and eradicate this problem by enabling customers to complete complex transactions online without supplying further proof of ID.

Owned and managed by the individual, miiCard gives the user security for their personal data, allowing them to track, monitor and thus take control of their online identity. For businesses selling online to consumers, miiCard improves conversion rates, cuts operational cost and fights internet fraud.

miiCard also benefits users and vendors by creating trust between parties in a purely online environment, increasing convenience, consistency and simplicity of shopping online, speeding up transactions, reducing costs, improving customer satisfaction and easing regulatory compliance.