Help is at hand for anyone who has ever missed a payment, unwittingly exceeded an overdraft limit or struggled to budget each month. Launching today, Money Dashboard is an easy to use and free online personal finance service that helps individuals and families to manage their money more effectively.

After a Christmas of excess, January is the perfect time to once and for all take control of your spending and now it needn’t be such a daunting prospect. By bringing your bank accounts and credit card spending history together on one screen and recommending Ways To Save, Money Dashboard promises to take the hassle out of managing your money.

As well as helping individuals, Money Dashboard makes it simpler for families and couples to keep track of their income and spending by enabling them to automatically and securely aggregate their household accounts from multiple brands in a single view.

Users can access the Money Dashboard application from any computer with web access and it allows them to track and categorise spending, set budgets and helps them save. It can also be configured to send emails to alert users if they exceed their set budget or if they are about to go into overdraft. In future, it will also be possible to alert users to suspicious transactions on their account, and for users to log on to Money Dashboard from their mobile.

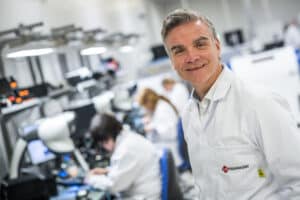

Gavin Littlejohn, Money Dashboard’s founder and CEO, says: “The Government has demonstrated in painful detail why it is important to keep track of spending and avoid getting into debt. It’s easy to put off reassessing your budget but now is the time to act on your New Year’s resolutions and take the first steps towards a brighter financial future.

“By giving people a clear picture of their finances, we can help consumers make better choices each month and recommend ways to save. Our aim is to take the fear and hassle out of managing money, focusing on helping young families and individuals to confidently manage their debt or create a path to better wealth. The UK consumer has shrinking access to financial advice, so it is important that they gain the confidence to self-serve, and Money Dashboard is designed to help them on that journey”

Since the service opened for public beta testing in May 2010, it has helped 10,000 users to manage their money more effectively. Thanks to feedback received from beta testers, the application has undergone several rounds of improvements as part of its evolution and new features will continue to be added following launch.

Chris Cathcart, a digital media strategist, was one of the first users to benefit from Money Dashboard during its beta testing phase.

He says: “I’m more aware of what I’m spending my salary on since using Money Dashboard and I’m less likely to spend money that I don’t have on items I don’t need. It’s easier to make financial decisions going forward as I have a really clear picture of my incomings and outgoings.

“The best feature of Money Dashboard is the option to tag your transactions. Once you’ve entered your details, the software categorises spending automatically so you can easily see the areas where you’re going over budget.”