Online accounting provider FreeAgent is giving away three months free trial of their service to celebrate the end of the tax year. Their service is specially designed to meet the needs of freelancers and small business owners, many of whom work from home.

More than 2.8 million UK businesses operate from home, and they’re a force to be reckoned with generating over £284 billion. ‘Being close to the family’ is a key motivation for home business owners, with 33% citing this as a reason for starting an enterprise from home. (Source: Enterprise Nation, Home Business Report 2009).

To benefit from FreeAgent’s promotion enter the special code “HOME” when signing up for a free trial on the site. The offer is valid until 30 April 2011.

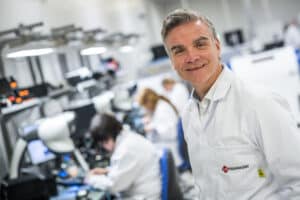

Ed Molyneux, founder and CEO of FreeAgent says: “The start of the new tax year is almost upon us so now is the perfect time to get on top of your accounts. Many freelancers and small business owners don’t look at their accounts because they’re worried about what they might find or it can seem complex and difficult. But hiding from your accounts is never a solution so instead, we want to give businesses an easy, clear and up to the minute picture of their finances to help them stop worrying.”

The FreeAgent software has a clean and simple design that is easy to use. As well as making accounting easy for business owners to understand, FreeAgent offers unique real-time projections of tax liabilities including VAT, Self Assessment Income Tax and Corporation Tax. Users can also analyse bank statements, see live profit and loss reports, send and track invoices, track time and expenses, and manage projects and payments.

FreeAgent has pioneered online accounting since the launch of its service in 2007, rapidly growing a loyal community of thousands of freelancers and small business users.

As well as making accounting easy for business owners to understand, FreeAgent offers real-time projections of tax liabilities including VAT, Self Assessment Income Tax and Corporation Tax. Users can also analyse bank statements, see live profit and loss reports, send and track invoices, track time and expenses, and manage projects.

The company is run by founders Ed Molyneux, Olly Headey and Roan Lavery who – originally freelancers themselves – needed a finance tool that would give them a clear picture of their business accounts and so FreeAgent was born.

When surveyed, a remarkable 99.5% of users said they would recommend FreeAgent to their friends, and it was voted Best SME Accounting Software in the 2010 Software Satisfaction Awards. FreeAgent is listed on the Telegraph High Growth Index for privately-held UK firms.

Hosted in the cloud, FreeAgent is accessible around the clock, from any internet connection, which is ideal for the way many small business owners and freelancers work.

FreeAgent is subscription based with costs starting at £15 per month for a sole trader, £20 for a partnership and £25 for a limited company.

Try it for free at www.freeagentcentral.com

Or follow @freeagent