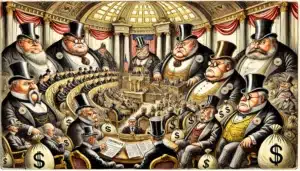

We’ve been here before – tight budgets and economic uncertainty – constant pressure to justify every penny. PR often finds itself first on the chopping block, dismissed as a “nice to have” rather than an essential business function. But what if that calculation is fundamentally flawed? What if reputation isn’t just some intangible asset but a substantial portion of your company’s actual market value?

The latest figures from Echo Research’s 2024 UK reputation valuation report should make every boardroom sit up and take notice: reputation now accounts for a staggering 30% of market capitalisation across FTSE 350 companies. That’s £719 billion of value, up 3.8% from 2023.

This isn’t theoretical value – it’s real money reflected in share prices and market caps. And it exists purely in the realm of perception, trust and reputation – the very domain that PR professionals are tasked with nurturing.

The study reveals something that profoundly changes the way we should think about PR spending. Far from being a fluffy luxury, strategic communication is actually safeguarding nearly a third of your company’s market value. Cut that investment, and you’re potentially eroding shareholder returns in a much more substantial way than the immediate savings might suggest.

Consider the top performers in the UK market. Companies like Shell, AstraZeneca, BP, Diageo and Unilever derive over half of their market value from the strength of their corporate reputations. That’s not coincidental – these are organisations that have invested consistently in telling their stories effectively, managing crises professionally, and building relationships with stakeholders across multiple channels.

What makes this particularly relevant now is that reputation serves as a buffer during uncertain times. While markets may fluctuate wildly based on political developments, economic indicators or global events, a strong reputation acts as a stabilising force, giving investors confidence to stay the course rather than heading for the exit at the first sign of trouble.

In fact, Echo’s research shows that 93% of FTSE companies saw their stock values bolstered by their reputations. However, there’s a cautionary tale too – 6% experienced a decline in market value, collectively losing £4.6 billion due to negative reputations.

The calculation seems straightforward: invest appropriately in maintaining and building your reputation, or risk watching your market value erode in real time. For a medium-sized FTSE 350 company, that could translate to tens or even hundreds of millions in market capitalisation at stake.

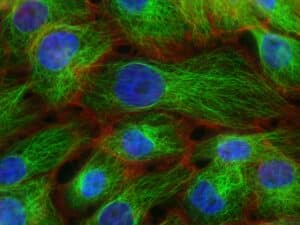

This isn’t just about crisis management either. The drivers of reputational value include long-term value potential, quality of products and services, financial soundness, and strong leadership. These are narratives built over time through consistent, strategic communication – precisely the domain of effective PR.

What’s fascinating is how this varies by sector. Energy and healthcare companies see some of the highest contributions to market cap from reputation, with figures reaching 40% above traditional financial metrics. By contrast property and consumer discretionary show more modest contributions.

The lesson? Not all PR strategies should be created equal. Industry context matters, and the approach must be tailored to the specific reputational drivers in your sector and the unique challenges your organisation faces.

When budgets are squeezed, the instinct is often to cut what seems non-essential. Marketing budgets contract, and PR is frequently first for the chop. But the data suggests this is dangerously short-sighted. If 30% of your market value is tied to your reputation, then maintaining visibility and positive stakeholder relations isn’t a luxury – it’s essential risk management.

The companies that understand this paradox – investing in communication precisely when others are pulling back – often emerge from difficult economic periods in stronger competitive positions. They maintain stakeholder confidence during uncertainty and position themselves to capitalise on opportunities when conditions improve.

With a third of your company’s worth tied up in perception and trust, cutting the budget for managing those perceptions isn’t prudent financial management – it’s potentially sacrificing hundreds of millions in shareholder value to save thousands in operational costs.

That’s not just false economy. In today’s reputation-driven marketplace, it might be the most expensive mistake a company can make.