Opening a new savings account or credit card online is set to become a lot easier thanks to a new partnership between ‘digital passport’ providers miiCard and data specialists Callcredit.

Until now, fraud and money-laundering regulations have meant that customers applying for a financial product online have usually had to follow this up by providing proof of identity and other documents by post.

As a result, up to 90% of sign-ups are never completed – meaning many customers are missing out on the attractive ‘online only’ rates offered by banks.

But in a major step for both consumers and the finance industry, miiCard and Callcredit have joined forces to provide a unique online identity service that removes the need for paper-based checks.

The miiCard (My Internet Identity Card) service allows a consumer to prove their identity online and in real-time, creating the same level of trust as a passport or driving licence. Callcredit’s award-winning identity verification software, which contains data on millions of UK consumers, gives an extra, robust layer of protection that ensures the service meets strict anti-money laundering and fraud regulations.

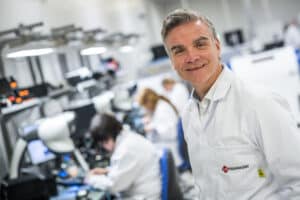

James Varga, Chief Executive of miiCard, said: “In a digital economy where there is a 70% to 90% drop out rate when selling financial products online as soon as the process goes offline, removing the drivers’ licence, passport and utility bill checks is critical. Creating this level of trust online will not only change the face of financial services but anywhere you need to know who you’re dealing with.”

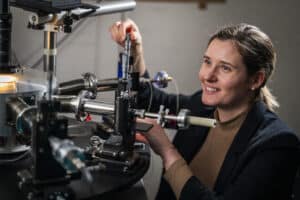

Graham Lund, Managing Director of Callcredit, said: “At this time of year, many consumers will be looking to get their finances in order for 2012 by taking advantage of competitive online banking offers.

“As a recognised leader in identity verification and fraud prevention, we have been working closely with miiCard to make it easier for customers to complete the sign-up process without compromising compliance with regulations or fraud rates. The new service provides a consumer-focused solution that combines the latest cutting edge technology with the widest range of robust data sources. Today represents a shift in the way consumers and companies will view identity verification in the future.”