miiCard, the purely online digital passport, has been selected as one of just ten finalists for the Innotribe $100K StartUp Challenge at the Sibos conference in Toronto, Canada on September 19-23, 2011 with digital identity a key theme for the conference.

Sibos is an annual member event for over 8,000 financial services senior professionals and the trade media. The Innotribe session is held on the final day of the influential industry event and pits a selection of promising companies against one another, in a ‘Dragon’s Den’ atmosphere. Last year, miiCard was voted ‘Most Promising Startup’ at the same event and this year is one of ten selected out of 200 applicants.

miiCard, powered by Yodlee, is a unique digital passport for the consumer that proves “I am who I say I am” in real time, for the first time. Owned and managed by the individual, miiCard allows the consumer to track, monitor and so take control of their online identity for the first time. miiCard costs the consumer a nominal fee and is charged to the vendor on a transactional basis. miiCard supports the UK, North America, Western Europe, India, Australia, New Zealand and South Africa.

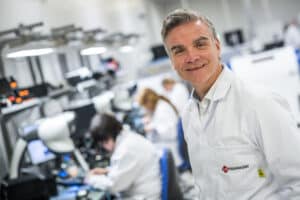

Stephen Brannan, miiCard’s latest board member, will take the stage for the Innotribe contest, bringing his considerable business and financial services knowledge to the fray. With 13 years experience in the international banking industry, including leading the Royal Bank of Scotland’s Separation Business Services team for the past five years, Brannan knows the industry well.

Brannan says: “I’m looking forward to the opportunity to talk about what miiCard is doing, and show where the company is going. Joining the board will let me bring my experience and expertise to help miiCard move to the next stage – and this event gives me a chance to talk about the future of this great company to an international audience.”

A patent pending global solution, miiCard demonstrated initial proof of concept to the financial services industry at Sibos last year. Its aim is to eradicate the final barrier to global trade, the need for offline proof of identity, before a financial product can be purchased.

Innotribe, a SWIFT initiative, is a set of events, tools and initiatives that enables collaborative innovation in financial services. It provides the infrastructure to find, co-create and invest in new ideas and projects.

Ends

For more information contact: Sarah Lee.

About miiCard

miiCard is a revolutionary “digital passport”, powered by Yodlee, that enables users to prove their identity online for the first time to the same level of authority as a driving licence or passport would do offline. By creating trust in an environment characterised by anonymity and transient identities, miiCard will open up opportunities for business online and put internet users back in control of their personal information.

The inability easily to authenticate a user’s identity online has long been a significant problem. Between 70% and 90% of all online financial transactions are terminated when the customer is required to provide physical proof of identity so it is imperative that businesses find a solution.

miiCard is designed to support ecommerce and eradicate this problem by enabling customers to complete complex transactions online without supplying further proof of ID.

For businesses selling online to consumers, miiCard improves conversion rates, cuts operational cost and fights internet fraud.

miiCard also benefits users and vendors by creating trust between parties in a purely online environment, increasing convenience, consistency and simplicity of shopping online, speeding up transactions, reducing costs, improving customer satisfaction and easing regulatory compliance.

James Varga – Founder and CEO

James is a Canadian entrepreneur with over 15 years of innovative technology and internet marketing solutions. In recent years, he has focused on developing Rich Internet Applications and User Experiences for global audiences. James has worked with leading brands in a range of sectors including Winterthur Life, Centrica Business Services, Thomas Cook and Sky Sports.

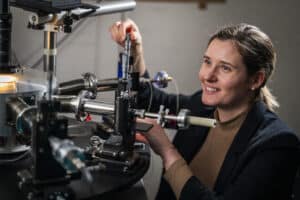

Stuart Fraser – CTO

Stuart is one of Scotland’s leading digital security experts. Co-founder of specialist IT security consultancy DNS, recently sold to SecureWorks, Stuart’s early career began in the energy sector working for Conoco, BP and Scottish Power.

Stephen Brannan – Board Member

Stephen Brannan spent 13 years at Royal Bank of Scotland, latterly as director of Separation Business Services, where he led the separation of a number of businesses as part of the RBS Group’s strategy to return to stand-alone strength, and further disposals dictated by the European Commission in return for state aid. Brannan also ran the RBS Cards business, was a member of the Visa EU board from 1999 to 2004 and has extensive experience of international banking.

Graham Paterson – Board Member

Graham Paterson was one of the founding partners of SL Capital Partners LLP and played a major role in the growth of that business from a team of two, with assets under management of £200 million, to a team of 40 and assets under management of £5 billion.

David Ball – Board Member

David Ball has held board positions with Tesco Bank and senior roles at HBOS plc and Bank of Scotland, managing IT and business transformation programmes.